Content

That it compensation could possibly get impression just how and you may in which issues appear on that it web site, along with, such, the order where they look within this checklist classes. Other variables, including our very own proprietary website’s legislation as well as the odds of applicants’ borrowing recognition, as well as effect just how and you will in which issues appear on this site. Finanso® doesn’t come with the complete universe from available monetary otherwise borrowing from the bank now offers. Discover a fast financing quickly, there are some available options, particularly if you you desire fast access to money. You to strategy is with for a quick payday loan, which is designed to offer small quantities of currency becoming paid on the next pay-day.

As to why They’s More challenging for those who have Less than perfect credit to get Approved to possess Financing

You can utilize a personal financing to own debt consolidation reduction, household renovations, big orders, scientific costs and you can money existence events. Heed structured expenditures unlike effect $255 payday loans direct lender sales to safeguard your financial health. Explore our personal finance calculator in order to estimate the monthly obligations. Get into your wished loan amount, fees term and interest. Which bank does not have any origination charge and offers exact same-day money.

Financing your organization that have a keen SBA-protected financing

If you are a hard borrowing query is not a problem, racking up some of him or her may have a significant impact on their rating. Soft credit monitors, compared, don’t apply to your credit rating. Because of this, you could potentially make an application for the loan without having to worry regarding your score delivering an initial-name strike. Whether or not secured recognition isn’t available in Australia, there are many more options for people with poor credit if any borrowing, so never lose cardiovascular system.

- Along with, PNC’s pre-acceptance comes with a strong dedication to give, for everyone consumers.

- Not one folks provides prime borrowing, but some is actually bad away from than others.

- When you express debt information and you will loan amount your’re also looking, you might be matched up with loan offers.

- These types of money are almost always recognized since the lenders hold limited exposure.

- Hence, delivering bad credit company start-up financing to the protected approval in britain is possible if you send out all of us the loan consult.

- Meticulously examine the new payment several months and you can rates to your additional loan now offers before you choose financing that meets your position.

I in addition to go through the better finance to consider if you has less than perfect credit, along with the best thing to do before taking away home financing. If the lender reports in order to credit reporting agencies, fast payments can be replace your credit rating. Although not, secured recognition inside perspective usually means the lender often not use your credit history since the first determinant within decision.

Kind of Money Which have Secured Acceptance

Implement today as a result of MoneyMutual and now have matched up that have lenders in minutes—no costs, no tension, without credit check expected. Our financing options to enable individuals to discover the a lot more help they need without the risk you to definitely specific poor credit fund have. CreditNinja’s exact same-go out options are unsecured, even for individuals with bad credit, which can be smoother to possess individuals who wear’t want to supply collateral. Cost fund is actually a variety of investment option you to definitely consumers pay off inside the regular payments.

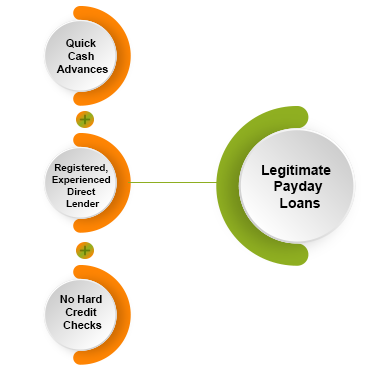

You can find a-sea of cons out there — or perhaps predatory lenders — it’s vital that you lookup before you take out a top-chance mortgage to the wrong lender. Payday loan are easy to get, so they’re also nearly secured, however still need to meet the minimal criteria to qualify, and you may you would like a checking account, as well. Money funded by the Borrowing Head® offer fixed rates away from cuatro.99% Apr so you can 29.99% Annual percentage rate for mortgage quantity from $step one,100 in order to $40,000.

Most personal bank loan loan providers favor individuals which have good to sophisticated borrowing results, meaning that a FICO Score of at least 670. The greater their get, the more likely you’ll be to get approved to discover the best rates. The working platform referenced in this article, MoneyMutual, isn’t a primary financial and does not issue money otherwise build borrowing decisions. Alternatively, they functions as financing connection provider, coordinating pages having independent loan providers. The fresh invited of financing render, the brand new regards to cost, and you can people ensuing monetary agreements try only involving the debtor and you will the financial institution. A hard borrowing from the bank inquiry is also lower your credit history, especially if you’re already to your shaky ground.

It means your’ll want to make large repayments, which can filters your money even more, especially if you have a strict finances. Conventional signature loans away from financial institutions, borrowing from the bank unions or on line lenders is generally a far greater alternatives than secured signature loans, even if you has less than perfect credit if any borrowing from the bank. Some loan providers offer no-credit-take a look at fund, but they usually come with high rates of interest and you will charges. Most reliable lenders create no less than a delicate credit assessment to help you evaluate chance.

Of numerous borrowers have fun with installment fund to have less than perfect credit so you can combine almost every other high-focus bills. In the event the accepted, you could potentially implement the financing to credit card debt, overdue resources, or pay day loan balances—assisting you win back monetary control. There isn’t any “catch” when using a credible program, but it’s vital that you note that guaranteed approval normally identifies higher matches prospective—maybe not automated financing financing.

Plenti is customize that loan substitute for suit your issues, along with competitive rates and versatile have, also instead a good credit score. Are you looking for a loan nevertheless discover you can find black marks in your credit report? Or at least you happen to be young, fresh to the newest employees and now have zero credit score.

This approach supports responsible credit and assists customers avoid so many monetary strain. Adding your spouse while the an authorized member could help their credit, and it will surely not damage your own. Your credit rating try a representation of the credit score, so your rating claimed’t are your own partners.

Upstart approves borrowers having a credit rating from 3 hundred, along with individuals with no credit score whatsoever. The new AI-inspired financing program takes into account items beyond borrowing, and degree, work and money. The greater your credit score, the higher your chances of recognition to your financial products that have a great straight down rate of interest. Start by MoneyMutual’s free, secure setting and you will apply at loan providers happy to fund your—quick.